Whether remortgaging or selling the last thing you need is a down valuation!

Down valuations happen when a lender's surveyor decides the property isn't worth either the amount you've agreed to sell it for or the price you think its worth on a refinance.

Are down valuations happening more often?

It's reported that 2020 saw a record number of down valuations.

A survey by Bankrate UK (an online mortgage comparison and financial informational site) found that 46% of prospective buyers saw properties down-valued in 2020, with the majority of homes down-valued between £5,000 and £10,000.

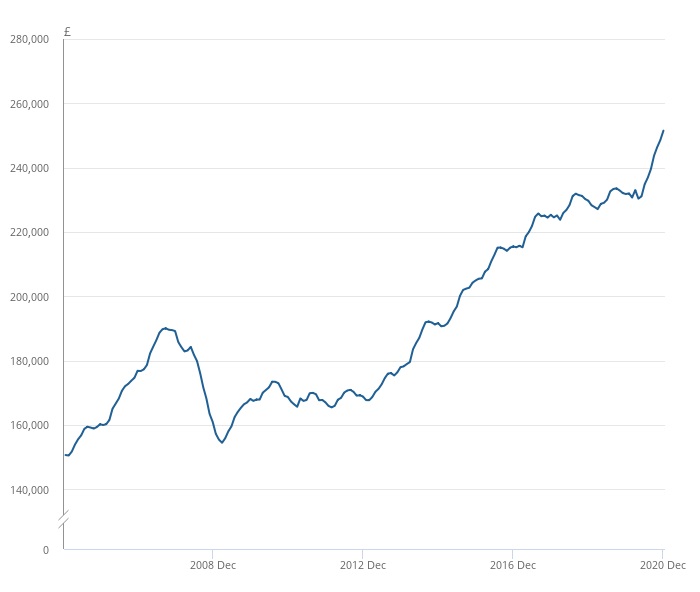

The property market has outperformed many peoples' expectations since March 2020. As shown below we are now seeing average prices across the UK far exceed the 2007 housing market peak:

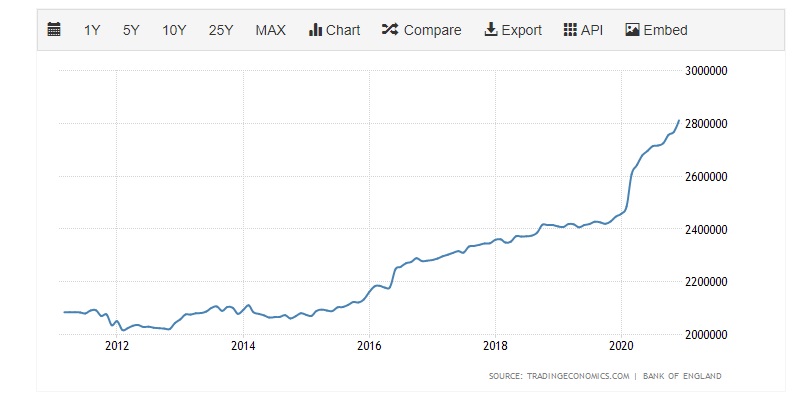

With interest rates at record lows and a staggering £875b in Quantitive Easing purchases as of November 2020 (equating to 40% of annual UK GDP!), many of these newly created currency units have been finding their way into the property market through fixed term credit securities such as mortgages.

In fact, since the pandemic began the UK has seen an increase in their broad M2 money supply by 14% as shown in the below chart:

When we consider the lack of supply in the market throughout the first half of 2020 and the increase in available lines of credit it's no wonder property prices have shot up!

With inflation at 0.8% and interest rates at 0.1%, many people have seen property as a good investment in an uncertain market to achieve a real inflation adjusted return on their money.

However, with such rapid price growth in such a short space of time, it's not uncommon for valuers to reduce their exposure (and therefore accountability) to protect themselves and their clients from a possible market downturn. After all, many lenders were left overexposed during the 2008 housing crash and want to ensure they don't make the same mistakes again.

Why is this a problem for buyer and seller?

As a buyer, let's say you buy a property for £300,000 but the lender's valuation comes in at £290,000, the property's been down valued by £10,000. This shortfall means you wouldn't be able to borrow the amount you need to buy the property so would have to find the extra money to pay the agreed price or renegotiate with the seller. Both situations run a higher risk of the transaction falling through.

Why is this a problem for investors when remortgaging?

While some investors prefer to buy income producing properties based on their current rental yield, there are others who purchase rundown or underperforming properties with the intention of adding value through a refurbishment before renting it out at a higher rent. This strategy is known as Buy, Refurbish, Rent, Refinance (or BRRR for short). By refinancing on the improved (post refurbishment) property value, the investor can recycle much of their original capital (maybe even all of it if the deal is good enough!) which in turn can be used to purchase another property and repeat the process over again.

For example, an investor buys a property for £100,000 cash and spends £30,000 on a refurbishment. They've spent £130,000 and based their figures on the property being refinanced at £160,000. With an 80% LTV refinance the investor would receive £128,000 from a lender. This means he would only have £2,000 of his original £130,000 capital remaining in the deal. The investor has therefore generated a high-quality income producing rental property AND recycled the vast majority of his initial capital from the refinance which gives him the opportunity to move to the next project and repeat the process (without having to find any more money to do it!). The money he is receiving in rental income would pay the mortgage costs.

However, if the remortgage valuation came back with a figure of £140,000 (as opposed to his expected £160,000), the same 80% LTV mortgage would return him £112,000, meaning instead of the £2,000 he had been expecting to leave in the deal he now has £18,000 tied up which he can't access.

Depending how he structured his finance this down valuation could cause significant problems. Short term finance, whether via bridging loan or other form of private equity loan, could mean he is paying a much higher percentage in outgoings until the full balance of borrowed funds can be returned to the cash provider, therefore causing real cash flow problems!

How to reduce the risk of a down valuation happening for you

The likelihood of overturning a down valuation is low. The aim is to therefore ensure everything is done to lower the probability of one happening.

Here are some key points to consider:

1. Know your lender. Be familiar with their mortgage products and requirements. Whether you're buying or remortgaging make sure you know what mortgage product the surveyor is being asked to produce a valuation report on. For example, if you have an 8-bedroom HMO but the lender only covers up to 5-bedroom HMOs, you will not receive the valuation you're looking for!

2. Use a lender with experience in the area. They should have a good understanding of your target rental market. As a property investor there are multiple rental markets such as students, professionals and supported living.

3. Ask your Agent for recommendations. Agents deal with hundreds of property transactions every year. They will be in good position to know which lenders are doing deals.

4. Be conservative when appraising deals. Have a best case and worst case scenario to make sure the numbers work various scenarios. Stress test your deals and always have another exit strategy/Plan B should you not get the valuation you expected.

5. Use a Mortgage Broker who is familiar with the area. They should know which valuers are providing overly cautious valuations.

6. Meet the surveyor on valuation day. If you've carried out significant improvement works, show them project photographs and provide them with a valuation pack with good comparable evidence justifying your target price.

If you are confident in the appraisal numbers you should achieve your target price. However, we would always recommend thorough stress testing of any deal. The aim is to reduce the probability of a down valuation by 1) being conservative with your appraisal by knowing your numbers 2) knowing your lender's requirements and 3) delivering a good product to the market.