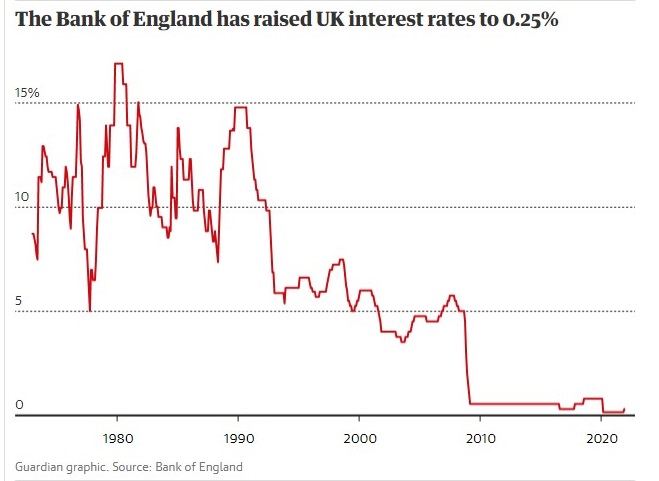

Last week the Bank of England chose to raise interest rates from 0.1% to 0.25%. This is the first rate rise for 3 years as interest rates have been held at 5,000-year lows.

The decision to increase was made almost unanimously by the Monetary Policy Committee (MPC) as they voted 8 to 1 in favor of the rate rise.

Why did they raise rates?

The most recent CPI data records UK inflation at 5.1% (almost three times the official BoE target level), the highest it's been for decades with much of this upward pressure being ascribed to rising energy costs and logistical problems caused by global supply bottlenecks.

The banks decision to take this moment to announce a rate rise amid the potential economic impact of the Omicron variant (as well as further restrictions in the pipeline) seems odd, however, it also suggests how concerned they are about the outlook for inflation, particularly as it is forecasted to continue towards 6% in the new year.

The BOE is the first of the three major western central banks (Boe, ECB and FED) to announce a rate rise which is unusual because historically it is the US Federal Reserve (who control the world's reserve currency of the dollar) that makes the first move before the others follow in kind. However, the US has its own problems with the eyewatering amount of new debt its issued in the past 2 years so it seems the BoE are breaking rank. The ECB also recently announced it would be scaling back its multi-trillion QE pandemic support program in a bid to reduce inflationary pressure on real goods and services.

The banks decision to take this moment to announce a rate rise amid the potential economic impact of the Omicron variant seems odd, however, it also suggests how concerned they are about the outlook for inflation, particularly as it is forecasted to continue towards 6% in the new year.

What does raising rates actually mean?

When a central bank makes the decision to increase interest rates what they are actually doing is increasing the "overnight rate". This is the interest rate which institutional entities (generally banks) lend or borrow funds with each other in the overnight market. So the overnight rate is the interest rate the central bank sets to target monetary policy.

Why is this so important?

The rate at which insitituational funds, Money Market Funds (MMF), insurance companies and sovereign funds can borrow money short term impacts all debt instruments within the lending market, as well as the the Bond Market where new and existing debt is issued at regular auctions to investors who buy debt securities of different timeframes.

By raising the short term overnight rate you can expect those who are lending longer term (such as those offering mortgage products) to also increase their rate of interest as investors want to be compensated for having their capital tied up for a longer period of time. Long dated financial assets like these are also the most sensitive to expected changes in inflation and interest rates so their market value fluctuates the most.

How does this impact mortgage rates?

Borrowing money now costs more than it did before. Unless you have a fixed rate mortgage product you will now be paying more each month on the debt you owe.

What do BoE propose to do with rates in 2022?

Some economists and financial market analysts are predicting up to three more rate rises in 2022 with rates potentially rising to 1pc - their highest since 2009 - as early as August 2022.

There is real concern that inflation could become uncontrollable, particularly given the possibility of further supply shortages of equipment, labour and materials in some sectors due to the ongoing pandemic.

What is the best thing to do to protect yourself from rising rates?

If you believe the UK is heading into a period of prolonged inflation then a smart tactic is to take out long term fixed rate debt like a mortgage on buy to let property.

This is because not only will you be repaying the debt with money worth less than the day it was taken out, but you will also benefit from any capital appreciation of the property while also being able to regularly review rent in line with RPI levels.

If you're currently operating on a standard variable rate then there is still time to switch to a fixed rate product before any further rate increases are decided.