This year a record 2.2m full time students are at UK universities, up 8% from last year with even more students studying away from home.

In fact, almost 222,000 more students are studying away from home today than 5 years ago.

So, despite tuition fees being at all time highs, many young people are still wanting to study in the UK, mainly because our universities have continued to enhance their global reputation.

Leeds has seen a 2% increase in full time students this year, taking the total no. to almost 61k.

Here are 4 x reasons why I believe rental demand for student House of Multiple Occupancy's (HMOs)s is going to be high for the coming years:

Value for money

Between paying for tuition and accommodation costs studying at university today is not cheap, and with souring inflation its likely affordability is going to play a large factor in a student's accommodation choices in the coming years.

Expenses are increasing but their Maintenance Loan finance remains the same.

This is where HMO properties provide much needed affordable accommodation to students. They are cheaper than Purpose Built Student Accommodation (PBSA) and generally located within walking distance to campus, thereby providing further savings on travel expenses.

Its therefore inevitable this will influence where students choose to live while studying.

Demographics

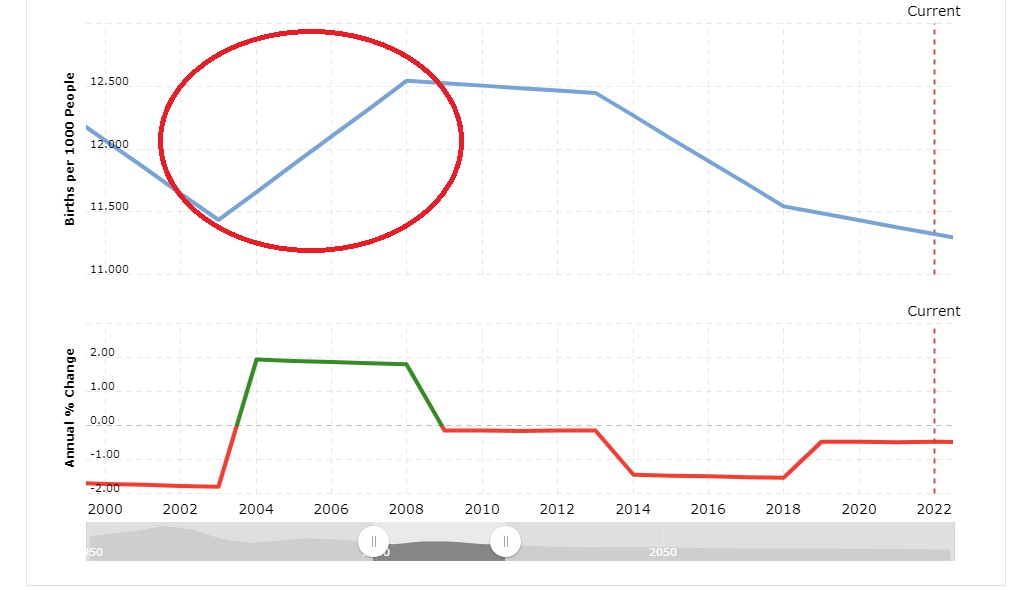

Based on current demographics there will be an increasing number of young people turning 19 until 2030:

We therefore expect demand for higher education study to continue to grow, particularly as we look at a possibly recessionary economic environment and weaker employment prospects in the workplace.

Turbulent economic times

While few industries are impervious to economic downturns, the student rental market is better placed than most. Those tenants in full-time education are less likely to default on their rent when others may experience higher job insecurity.

Growth of PBSA likely to slow

Despite rapid growth of PBSA market in recent years they are now facing some serious headwinds in the form of inflation.

The rising price of steel, timber, labour, insurance premiums, as well as the current geopolitical climate, have all contributed to an increase in build costs, while rising energy prices are having a significant impact on operational costs in the sector.

With possible fewer bedspaces being released to market than initially forecasted, the demand for HMOs will continue to remain high.

Despite this, landlords shouldn't get lazy. PBSA is a relatively new asset class who have been aggressively growing market share over the past decade. Their shiny new buildings have forced the arm of many landlords to increase the standard quality and service of their properties to remain competitive, which is not a bad thing!

If you want the best tenants, houses need to be of a high standard.