Well 2022 was fun, wasn't it? What delights could 2023 have in store for us all?

Here are my top ten predictions for the student rental market in 2023.

1. Affordability will be a key issue for students

According to a study by Unipol, 55% of students said they were struggling to manage their living costs because of the rent they currently pay. A further study by Save the Student found that 1/3 students said they don't see their accommodation as good value for money.

Both are pretty shocking statistics but when we consider double digit inflation, 150% increase in utility costs within 12 months and student maintenance loans not increasing at all, it should come as no surprise.

While landlords are also having to whether the storm of rising mortgage and utility costs, its important they keep their finger on the pulse regarding rents. Although expenses may be higher, do not price yourself out of the market because value for money is now the prime factor in a student's accommodation choices.

2. Demand will continue to outstrip supply

A combination of record high students applying to university since the pandemic and a recent decline in available rental properties (as landlords downsize portfolios due to Government policy) has created the perfect storm across the country. There are now not enough student bedspaces available to meet demand in a lot of the UKs major student towns and cities.

So in addition to rising mortgages and utility costs, excess demand will likely contribute to further rent increases nationwide throughout 2023.

3. PBSA development will slow down

Another factor likely to affect the supply shortage is the slow down in new Purpose Built Student Accommodation blocks being built.

Despite rapid growth of PBSA market in recent years they are now facing some serious headwinds in the form of inflation.

The rising price of steel, timber, labour, insurance premiums, as well as the current geopolitical climate, have all contributed to an increase in build costs, while rising energy prices are having a significant impact on operational costs in the sector.

4. Landlords move towards improving property efficiency

Higher energy costs have resulted in higher living costs for students. As a result, many properties aren't being heated correctly which is resulting in condensation, damp and mould problems.

According to Unipol damp issues have been the most reported complaint in 2022, as shown in below graph:

Its no coincidence this type of complaint has increased at the same time energy costs are at record highs.

As the energy crisis continues I believe responsible landlords will start carrying out energy efficiency improvements to mitigate damp issues now, as well as futureproof properties for possible legislation changes in a few years. To be clear there is no confirmation this will happen as of today, but it is wise to get plan ahead now as it is expected to be announced in the coming years.

According to a study by Unipol, 55% of students said they were struggling to manage their living costs because of the rent they currently pay. A further study by Save the Student found that 1/3 students said they don’t see their accommodation as good value for money.

5. Yields will expand

While some market experts predict house prices to fall 15% - 20% in 2023, I am not as pessimistic. However, I do believe a correction is coming this year.

Home prices are determined by availability of supply and cost of debt, and 2022 saw standard mortgage rates go from 2% in Jan to almost 6% by December.

Thankfully these are beginning to stabilise following the mini-budget calamity, but it is expected HMO rates will settle circa 5% in 2023 which could put a lot of leveraged buyers out of the marketplace.

With fewer buyers there will of course be opportunity for investors sat on cash, but with rents expected to rise further any market correction in prices will lead to yield expansion for most of the country's good quality student property stock.

6. More HMO stock will come to market and present buying opportunities for investors

As touched on above, I believe some student portfolio landlords will continue to downsize their portfolios, particularly as Section 24 of the Finance Act is now in full effect. Mortgage rates have almost tripled and general property expenses are also at record highs due to inflationary pressures.

While some purchasers reliant on high LTV mortgage products are squeezed from the market, any drop in prices could be capitalised by cash investors with low gearing. After all, rents are not forecasted to drop!

7. Rents will rise

2022 saw rents pushed higher across the board. We have already rented a large amount of HMO stock for the 2023/24 academic year and have achieved an average 5% increase across the portfolio.

Although student finances are being stretched, I believe many landlords will continue to push rents to offset rising costs until a tipping point is found. We may be close to that point.

8. A decision is made on Private Rented Sector student exemption within the Rental Reform Bill

A concern for many student landlords is the proposed Rental Reform Bill and the removal of fixed term tenancies. If this comes to fruition it will change the way student properties are rented.

However, there is a lot of push back from the industry. The NRLA are doing a good job fighting this on behalf of student landlords and with multiple reports of student bedspaces running out across major student cities, the Government will be under pressure to not make the housing crisis any worse than it already is.

I believe the decision will be made at some point in 2023.

9. Bills included tenancies to remain in high demand

Despite the rapid rise in energy costs most students still prefer renting bills included.

They are favoured by students, landlords and parents and make budgeting easier. Students also do not like taking responsibility for chasing friends for money.

This trend will continue into 2023.

10. Increase in students applying to university

This year a record 2.2m full time students are at UK universities, up 8% from last year with even more students studying away from home.

In fact, almost 222,000 more students are studying away from home today than 5 years ago.

So, despite tuition fees being at all time highs, many young people are still wanting to study in the UK, mainly because our universities have continued to enhance their global reputation.

Leeds has seen a 2% increase in full time students this year, taking the total no. to almost 61k.

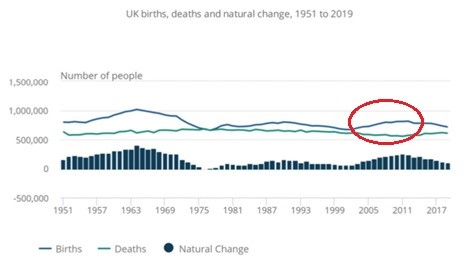

Based on current demographics there will be an increasing number of young people turning 19 until 2030:

We therefore expect demand for higher education study to continue to grow, particularly as we look at a likely recessionary economic environment and weaker employment prospects in the workplace.

So there you have it. My 10 predictions for the student housing market in 2023!

For a breakdown of this article please check out the following video: