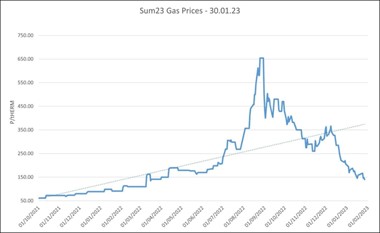

You may have seen that wholesale gas prices for the summer 2023 contracts have plunged by 80% and are now at pre-Ukraine war levels, yet today energy bills are still 200% what they were 12 months ago.

** Chart showing The Price Of Gas On The Wholesale Market In GB For Delivery Period - Summer 2023

With the UK energy price freeze guarantee coming to an end in April, its important for landlords to be aware of what's happening in wider markets so they can set themselves up to get the best energy deals available.

So does the recent drop in wholesale prices mean our energy bills will fall too?

I've spoken to a number of student energy suppliers this week asking this question.

Although the general consensus is positive and rates and trending are in the right direction, don't expect an immediate drop in prices.

The winter has been much warmer than predicted, not only in Europe but in the US and Asia too. This has resulted in less global demand for energy than initially expected. Furthermore, energy generated via offshore wind farms across Britain has boosted supply levels. This is why we're seeing a drop in wholesale gas prices, and as a lot of electricity is also made from gas, so too has the price of electricity dropped.

But right now retail energy cost in the markets remain high. And although I'm told its unlikely rates will go any higher from here, according to the two energy reps I spoke to its likely student bills inclusive prices will not only remain this level into the summer, but potentially won't return to "normal" levels until the 2024/25 letting season. They want to be sure that there is a consistent fall in costs before they begin to reduce their advertising prices.

But why?

Energy companies are tasked with ensuring the stability and availability of energy supplies for consumers. One of the ways they do this is by participating in the wholesale gas market where they buy and sell natural gas in bulk quantities. In this market, energy companies have the opportunity to purchase gas in advance at fixed prices, a strategy known as advance purchasing.

Advance purchasing is used to secure natural gas supplies for future use. By purchasing gas in advance, energy companies can lock in prices and secure supplies, reducing their exposure to price volatility in the future.

As suppliers predominantly buy energy months in advance on the forward market (years in some cases), what happens on the 'day-ahead' market has limited effect. The gas we're using today was likely purchased during the peak of the crisis.

It's only when there's a consistent fall in the cost of gas on the forward market that this will feed through to a reduction in energy bills. This "advanced purchasing" by the energy companies is supposed to help protect suppliers from being exposed to sudden price spikes.

So all of this doesn't make great news for landlords who, alongside the students themselves, are seeing their margins squeezed from increased overhead and operating costs. The current cost of high energy bills are stifling the possibility to increase rents to cover higher property expenses, as many students are struggling with living costs this year and already stretched their finances to the max.

So don't expect any immediate respite from high energy bills but on a positive note its good to see markets trending in the right direction and, fingers crossed, unless we see some unforeseen black swan event, the worst of the crisis could well be behind us.